Types of Housing In Singapore

There are 2 main types of housing in Singapore. HDB and private properties.

HDB is a type of subsidised public housing introduced by Singapore government for Singapore eligible households. You must fulfil your eligibility to buy either a new or resale HDB flat. Foreigners cannot buy any HDB in Singapore. Eligible households can only own 1 HDB flat.

There are sub categories under private properties such as private apartments or condominiums and landed houses (such as terrace house, Semi-detached house, bungalow, detached house)

Private apartments or condominiums

Foreigners are able to buy private apartments or condominiums in Singapore. Foreigners can buy more than 1 private properties in Singapore but applicable taxes will apply (ABSD) and we will share more about the tax structure below.

Landed Houses

Under the Residential Property Act, foreigners are not allowed to purchase any landed properties without getting the approval from LDAU (Land Dealings Approval Unit) under Singapore Land Authority (SLA).

Foreigners must also seek approval from LDAU for the following properties.

- Shophouse (for non commercial use)

- Vacant residential land

- Strata landed house which is not approved within an approved condominium development under the Planning Act (eg. Townhouse or cluster house)

However, foreigners can buy landed properties located within Sentosa Cove, where the land area of such property must not exceed 1,800 sqm. Approval from LDAU is still required and there will be conditions imposed, example, it is prohibited to purchase landed property in Sentosa Cove and rent it out (Under Residential Property Act). It is solely for own occupation purposes.

Taxes Applicable for Foreigners

Foreigners buying residential properties in Singapore are subjected to 2 taxes; Buyer Stamp Duty (BSD) and Additional Buyer Stamp Duty (ABSD).

Buyer Stamp Duty (BSD)

I have another article that illustrates the latest Buyer Stamp Duty calculation. Please read more about it here.

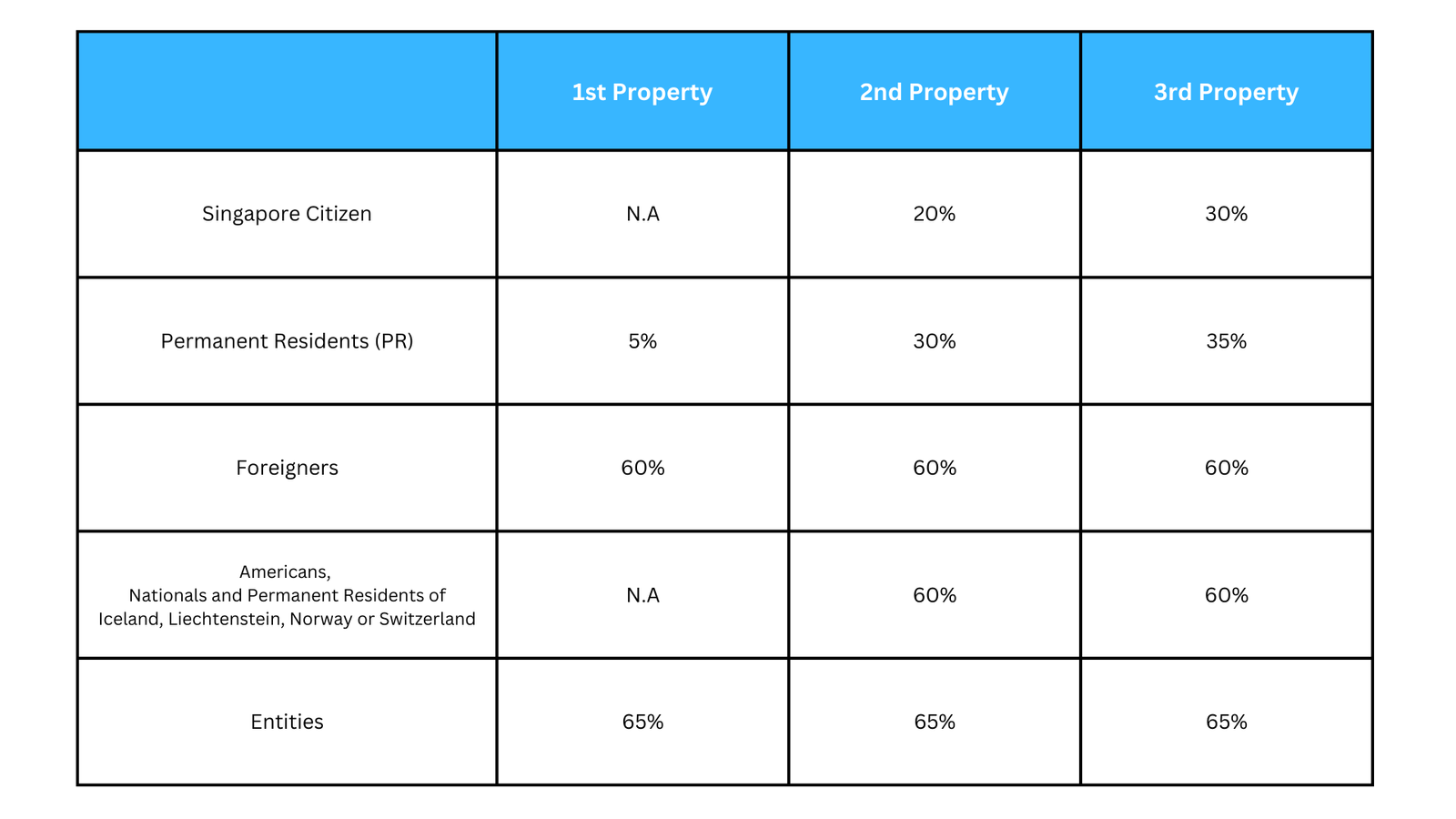

Additional Buyer Stamp Duty (ABSD)

Foreigners need to pay ABSD along with BSD. The ABSD payable for the first property purchase is 60% of the purchase price or market value (whichever is higher). The applicable ABSD on subsequent property purchase is the same rate too. Refer to the table below.

The introduction of ABSD by Singapore government aims to moderate demand for residential property, to ensure that Singapore residential property remains affordable for Singaporeans and that real estate prices move in tandem with economic fundamentals.

There are however exceptions on Nationals from these countries who are exempted from ABSD due to existing trade agreements Singapore has with the United States and with the European Free Trade Association (EFTA), thereby allowing these nationals similar property privileges to Singaporeans. They are:

1. Nationals and Permanent Residents of Iceland, Liechtenstein, Norway or Switzerland

2. Nationals of the United States of America

Foreigners whose spouse is a SC or SPR

Foreigners with Singapore Citizen (SC) or Singapore Permanent Resident (SPR) spouses are allowed to purchase selected public and private housing in Singapore. If you’re a foreigner and married to a Singaporean Citizen, you can apply for or 2-room flexi BTOs or resale flats under the Non-Citizen Spouse Scheme. Apart from that, you’re also eligible to buy resale EC units after their 5-year MOP as opposed to just privatised Executive Condominium (EC) at least 10 years old.

If you are a foreigner and wishes to understand more about the Singapore real estate market, let us set up a discussion and i will be able to answer your queries.