(Updated on 21 Feb 2023)

In Singapore, there is one thing that every purchaser of property must be aware of: the Buyer’s Stamp Duty (“BSD”). This is a tax you have to pay when you buy or transfer ownership of a property in Singapore.

The BSD amount you will pay for purchasing a property will depend on the market value or purchase price – whichever is greater. In other words, if you were to purchase a private residential worth $2.5 million for $2.3 million after negotiations, your BSD will still be determined by the market value of $2.5 million rather than your actual purchase price.

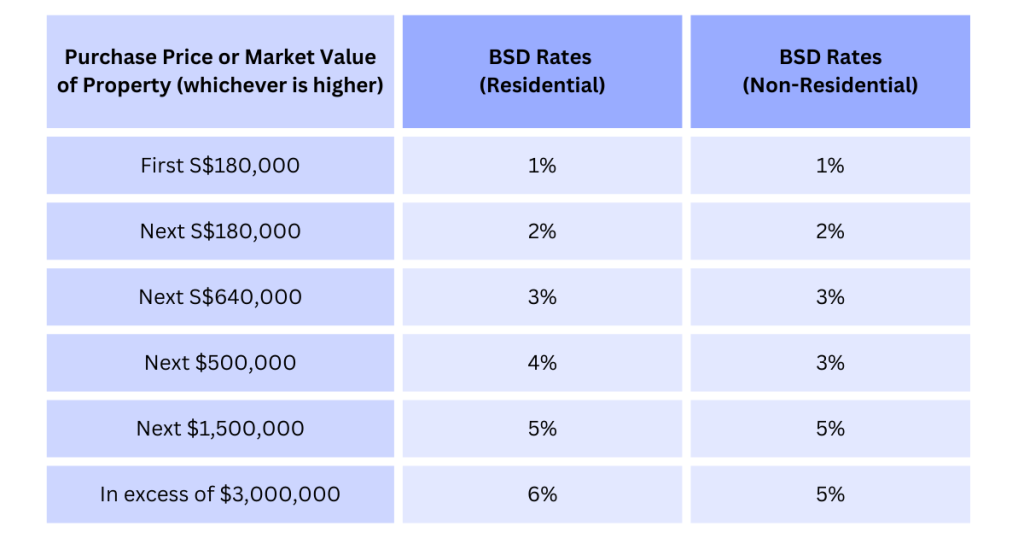

An overview of Singapore BSD rates (Updated)

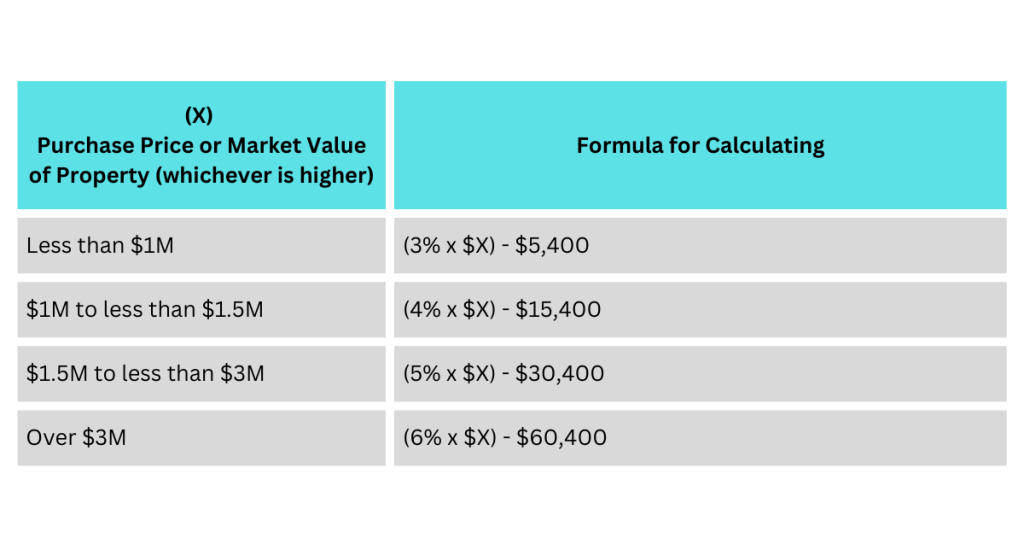

You should be aware of how to calculate the BSD as a property buyer, so that you can better gauge the costs of your acquisitions. The BSD levied on residential properties can be up to 6% as of 15 February 2023, while the BSD imposed on non-residential properties is up to 5%. This is a quick overview of the BSD’s structure:

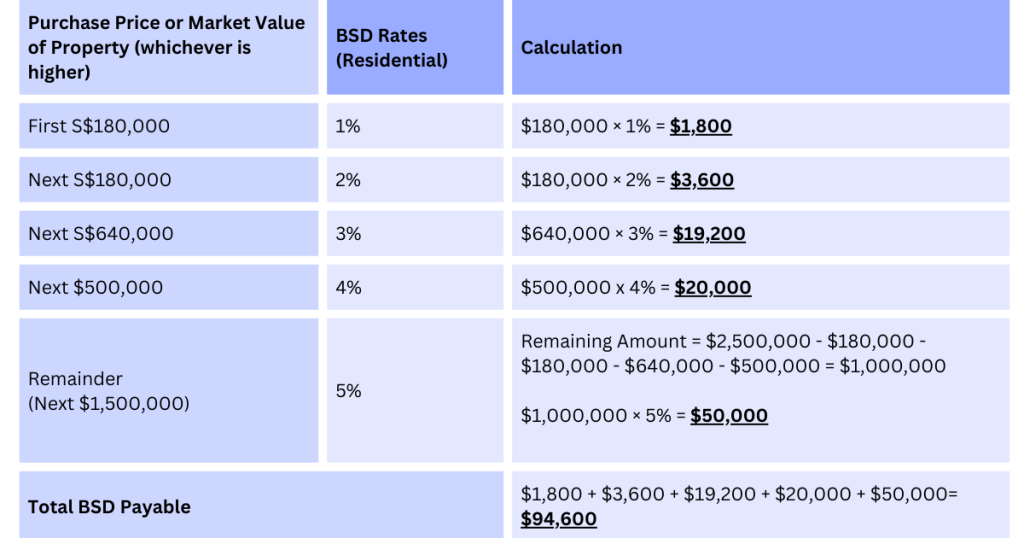

How to calculate the BSD (Example of Private Residential property)

Purchase Price : $2,300,000

Market Value : $2,500,000

Because the market value is higher than the purchase price, the BSD payable is calculated based on the market value. A quick way to calculate is to use this formula ($2,500,000 x 5%) – $30,400 = $94,600

See below (A) for the detailed calculations:

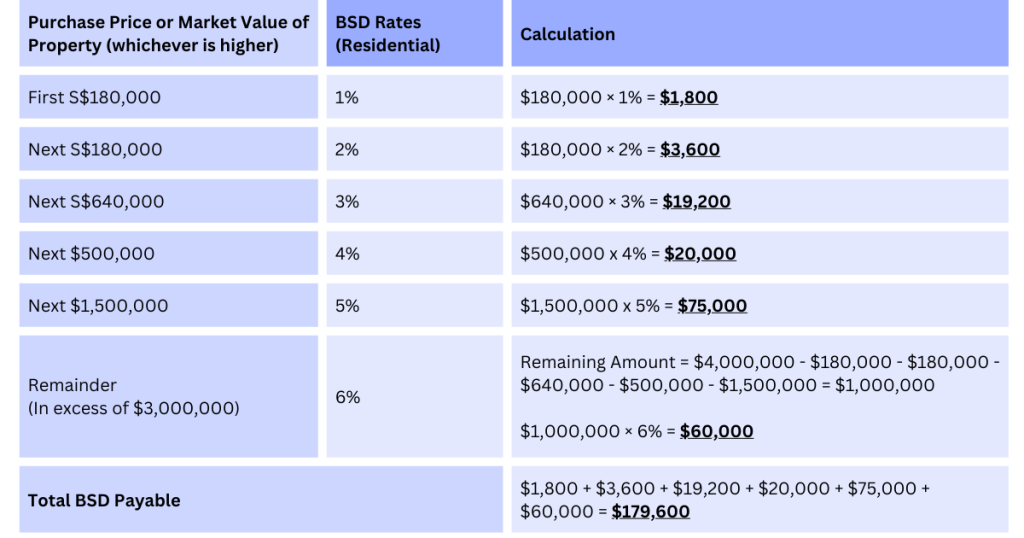

How do you calculate if the market value is over $3 Million?

Market Value : $4,000,000

A quick way to calculate is to use this formula ($4,000,000 x 6%) – $60,400 = $179,600

Look at below table (B) for the detailed calculation.

Too confusing? Here's a quick formula to apply to calculate BSD easily.

Example of a shophouse (with Residential and Commercial) property

Purchase Price : $4,000,000

Market Value (Commercial Component) : $2,800,000

Market Value (Residential Component) : $1,200,000

In this example, let us explore the BSD of a shophouse, which can be used as both a residential and a commercial property. If you were to purchase such a shophouse at a market value of $4,000,000, with its commercial component valued at $2,800,000 and its residential component valued at $1,200,000, your BSD payable for the shophouse will be:

Formula to calculate BSD for Commercial Property: ($2,800,000 x 5% – $30,400) = $109,600

Formula to calculate BSD for Residential Property: ($1,200,000 x 4% – $15,400) = $32,600

Total BSD Payable = $109,600 + $32,600 = $142,200

Paying your BSD

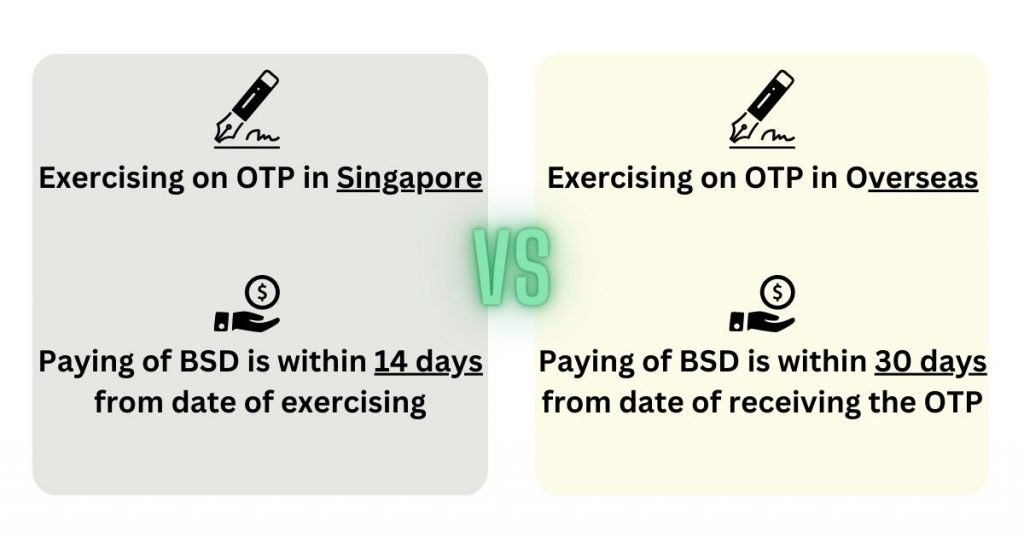

Late payment of stamp duties is going to result in hefty penalties, hence it is essential to be aware of the deadlines and payment requirements in order to avoid unnecessary penalties.

For private property transactions in Singapore, the deadline for BSD payment is 14 days from the date the agreement is signed, namely when the last party signs it. A buyer who exercises an Option to Purchase (“OTP”) granted by the seller will have 14 days from the date of exercise to pay the BSD to IRAS. In the event that the transaction was signed overseas, the BSD payment deadline is 30 days after the agreement has been received in Singapore.

The BSD must be paid in full and cannot be paid in installments. The BSD can be paid by e-stamping on IRAS’s website. Alternatively, you may leave this matter to your law firm. When you exercise your OTP, your conveyancing law firm will be responsible for collecting the BSD amount from you.

Can I pay the BSD using my CPF savings?

If you wish to pay stamp duties with your Central Provident Fund (CPF) savings, you may do so only for residential properties.

It is not possible to use CPF funds to pay for the BSD when purchasing a commercial property.

Due to the 14-day BSD payment deadline after exercising the OTP for a resale property, you may have to pay your BSD with your personal funds first, and then apply for a refund from the CPF Board (CPFB). Usually, your conveyancing law firm will advice you to apply for the stamp duty refund together with your application to use his CPF savings to purchase a property.

In the case of buying a private new launch (building under construction), you may pay the BSD if your CPF has sufficient funds. This is different from buying a resale property.