Introduction on the emotional traps that many of us are facing when it comes to real estate asset.

When it comes to property investment and upgrading, many buyers are faced with many questions.

Is upgrading for me?

Is it too late to buy?

Will I get negative cashflow?

Can my rental cover my mortgage costs?

In this blog, I shall unlock the answers for my readers.

Private apartments or condominiums

Foreigners are able to buy private apartments or condominiums in Singapore. Foreigners can buy more than 1 private properties in Singapore but applicable taxes will apply (ABSD) and we will share more about the tax structure below.

What type of mentality do you belong?

Generally there are 2 types of investors:

The Fixed Mindset person tends to seek for stability and usually are the ones who already precondition themselves that it is impossible for them to own any assets. They are the ones who will always reply no to whatever proposals you have for them and their heartbeat will not even race wildly even when there is a great deal dangling right in front of them. Most of them also feel that they need to save enough money before investing.

The Growth Mindset person is someone who is eager to learn and attain knowledge. Such person also regularly update themselves with the market information and is actively seeking out for opportunities. This group of people believe in investing and will invest rather than saving their money.

The mindset is such a powerful thinking that can shape you to how you believe in something or yourself. Your mindset influences exactly how you think and feel about something. Many great investors out there are not created out of pure luck. They believe in investing and are actively looking for the right opportunities to stay invested. It is important to adopt an open mindset; Growth Mindset.

Everyone of us have emotions and it is common to feel them. Sometimes we get emotions because of the pricing, you also wonder whether you are too late now, and most people actually feel that “I should have bought a few years ago” and etc. All these emotions may have prevented us from taking actions. Have you ever felt this, “I want to buy but what if I lose money?” It is a common emotion. Such emotion is there to protect ourselves and to keep us safe. On the other hand, these emotions can be an obstacle that keep us from taking action. So the key is to handle our emotions objectively to make the right decisions.

1st Emotional Trap: Your Price is Too High

It is common to hear people around you telling you that the property price is too high now. Some of these people that you hear from in fact have not ever bought any property in Singapore too

So on what basis are they making such conclusion? At this point, we should really do research and tell us whether the property price is too high and understand the market better.

The fixed mindset person will just simply accept that the property price is too high and will not do anything further to confirm the matter. On contrary, a Growth Mindset will want to find out, do research and gather information to seek for answers.

So it is really important for people with fixed mindset to ignore comments and seek to get answers through proper research.

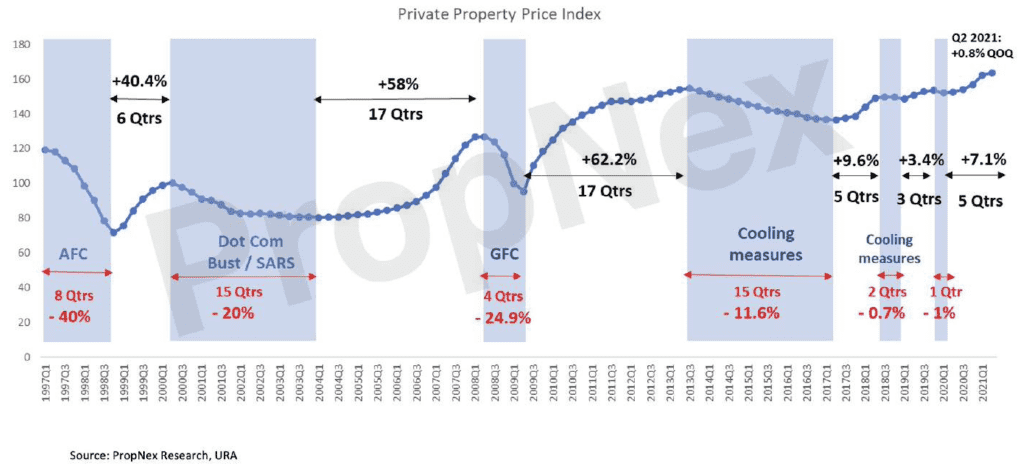

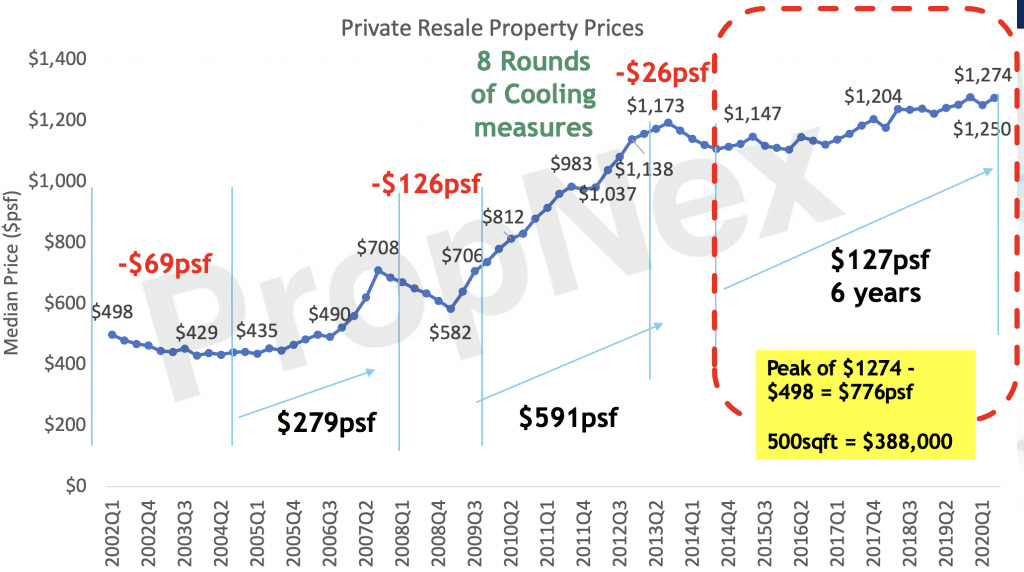

Let us look at the Private Property Price Index (PPI) Chart below.

The Collapse of Lehman Brothers in 2008 and Global Financial Crisis 2009 has caused the PPI to drop -24.9% in 4 quarters consecutively in Q3 2009 but market was recovering and prices met new highs.

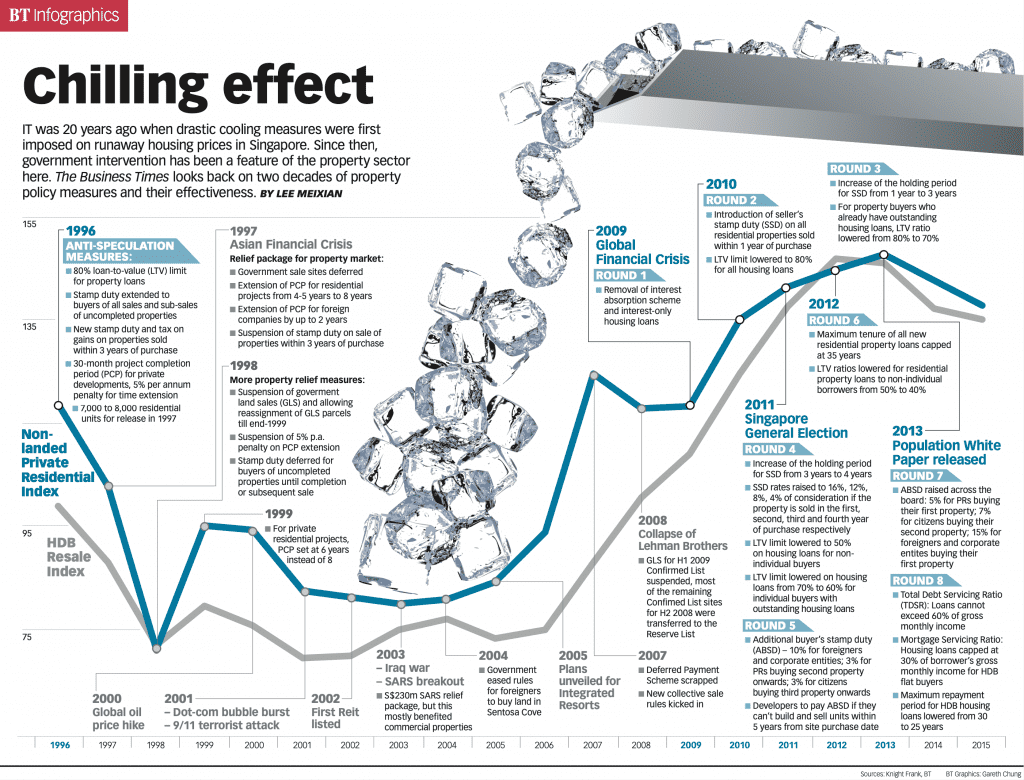

In order to cool down the market, the government introduced new cooling measures.

In 2010, the Seller’s Stamp Duty (SSD) was introduced to prevent speculation of market to avoid artificial inflation of the prices but the prices still climbed.

Then in 2011, another round of cooling measure was introduced. This time, the ABSD was raised across the board. Singapore citizens at then have to pay 7% ABSD for their second property, PR had to pay 5% ABSD for buying their first property, foreigners and corporate entities buying their first properties had to pay 15% ABSD. Despite all these, the prices still went up.

Finally, in 2013, MAS introduced Total Debt Servicing Ratio (TDSR) which is really the bomb. This is the policy where it says that mortgage cannot exceed 60% of gross monthly income. This is an impact to investors who were previously leveraging or even over-leveraging on bank loans to purchase a property or multiple properties. The TDSR was the cooling measure that successfully cooled down the market causing the market to be depressed for 15 quarters, a decline of -11.6% in PPI.

Many people have asked me whether we will see another -24.9% scenario in today’s market? The answer is no, because Singapore government is monitoring the property prices and introduced proper cooling measures to cool the market if the prices run off track. A sharp increase or decrease is what the government wants to avoid. This is exactly why even the last round of cooling measure in 2018 only resulted in a decline of -0.7% and Covid19 situation has only resulted in -1.0% decline. However if you look at the latest PPI, it shows that the overall price index has climbed even higher than before. So imagine that if you have bought a property in 2007 at the peak and ride through all the crisis and sold your property in 2021, would you have made a profit or suffered a loss?

Source: Business Times

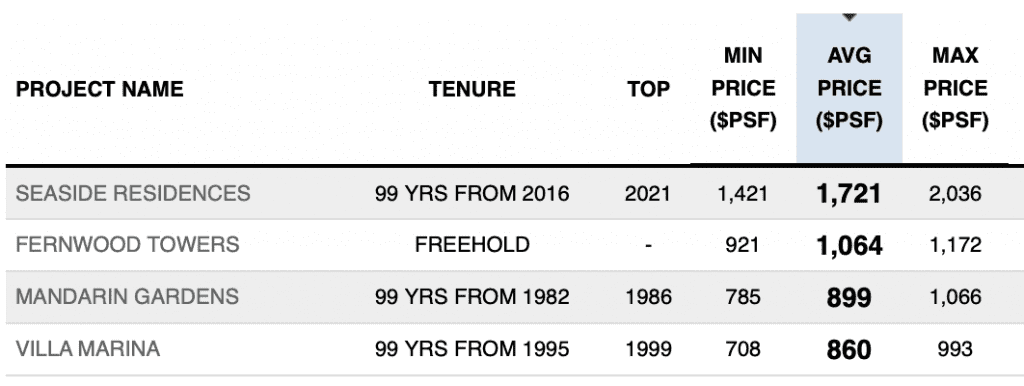

In 2017, Seaside Residences was launch at average $1721 psf and was much higher than the surrounding nearby developments, some of which are freehold properties too. At that time, many people laughed at the price and felt that the price is too high, some said if you buy Seaside Residences means it’s Suicide Residences.

Seaside Residences vs nearby properties

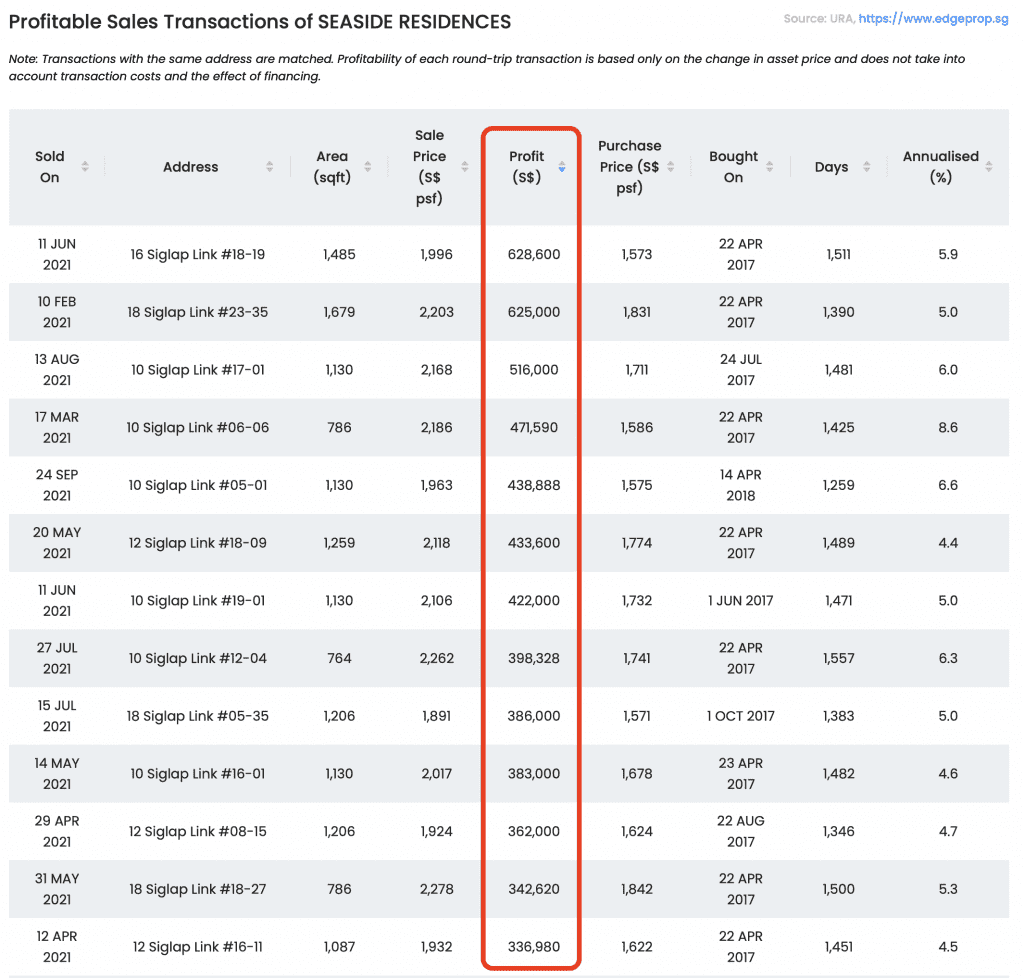

However, those owners who took action and bought Seaside Residences have reaped profit.

The highest profit was the transaction on 11 June 2021 (during pandemic) and has made the owner a profit of $628,600! Notice that some of the purchase price were between $1700-1842 psf and they could exit and sell higher price with profit than the surrounding older and cheaper developments?

When you look at the average private resale price, you can see that property prices have increased from $498 psf in 2002 to $1,274 psf in 2020. So imagine if you have bought a 500sqft unit at $498psf in 2002 and sold at $1,274psf in 2020, the profit is $388,000!

Real estate has a cycle and if you have kept the property for a long term, you will have made money.

That is why it is very important to buy into Current Price and not to buy into Future Price. Based on the chart above, you can also see that the new high is HIGHER than the previous high, and the latest low is HIGHER than the previous low. Every opportunity counts and we cannot and should not be looking back. Do you want to continue to look back and miss out opportunities?

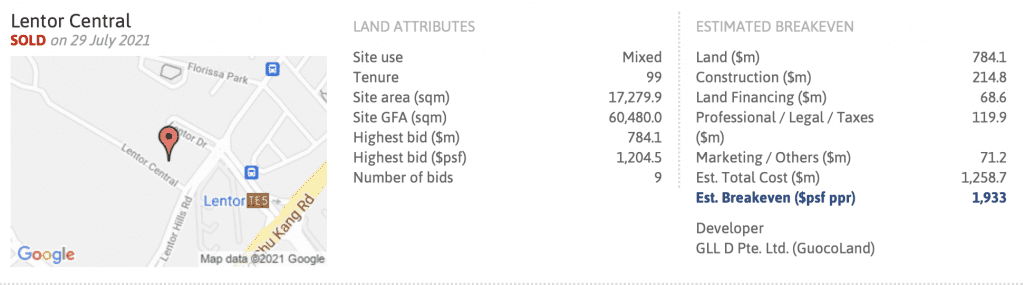

Here’s another example, let’s take a look at some of the pipelines in the OCR segment. We have below 3 land parcels sold under GLS. MCC Land clinched the plot at Tanah Merah Kechil Link, United Venture Development (JV between UOL Group, Singapore Land Group and Kheng Leong) secured the winning bid at Ang Mo Kio Avenue 1while GuocoLand emerged as the highest bidder for Lentor Central. So if you continue to wait and to take action eventually and bought into Lentor Central, you have to be mentally prepared to pay at least $21xxpsf ++ in the OCR segment. At $21xxpsf, you can buy a product in RCR segment today.

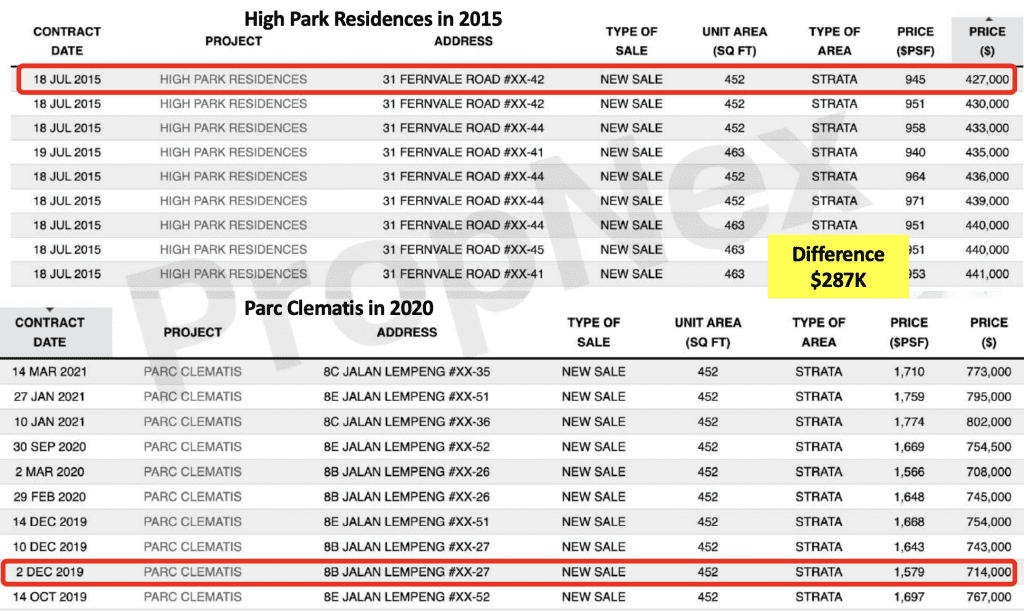

Just like High Park Residences, when it was launched, you could buy a 452sqft unit at $427,000 but you have to pay $714,000 for the same size in Parc Clematis in 2020! Yes, both are in difference location but still this is a difference of $287,000 over a 5 years period.

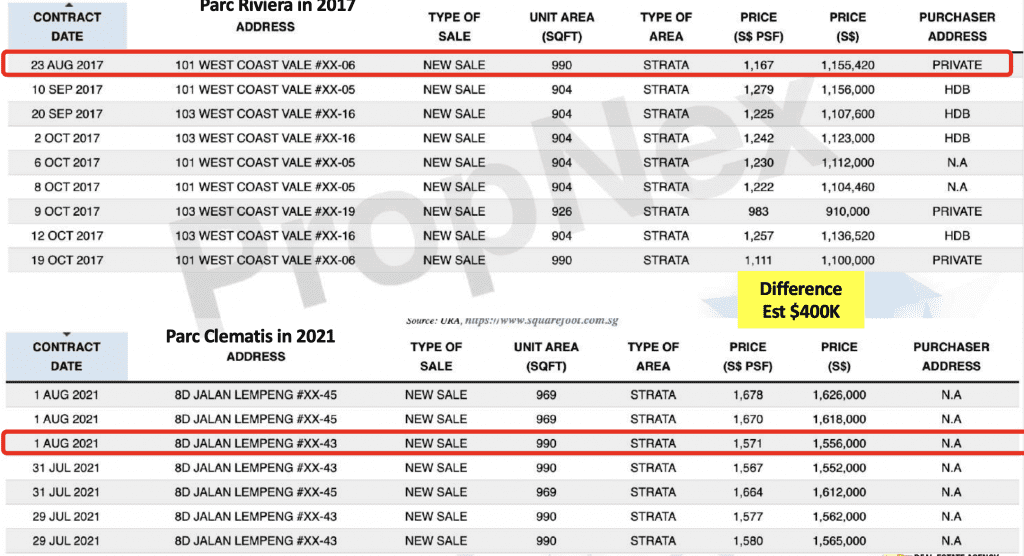

Would you pay $1,155,420 for a 990sqft unit at Parc Riviera in 2017 or pay $1,556,000 for a same size unit in Parc Clematis in 2021? This difference over 4 years is almost $400,000! Can you imagine the impact of moving forward? If you did not buy the Parc Clematis today and decide to enter into Lentor Central in future, let’s assume the price is $2,000psf , Lentor Central will cost you $1.98 million in future.

Bottomline, you still can get a good price new launch today. Make sure you do sufficient research.

Emotion 2 - I cannot afford the instalment. Too much…

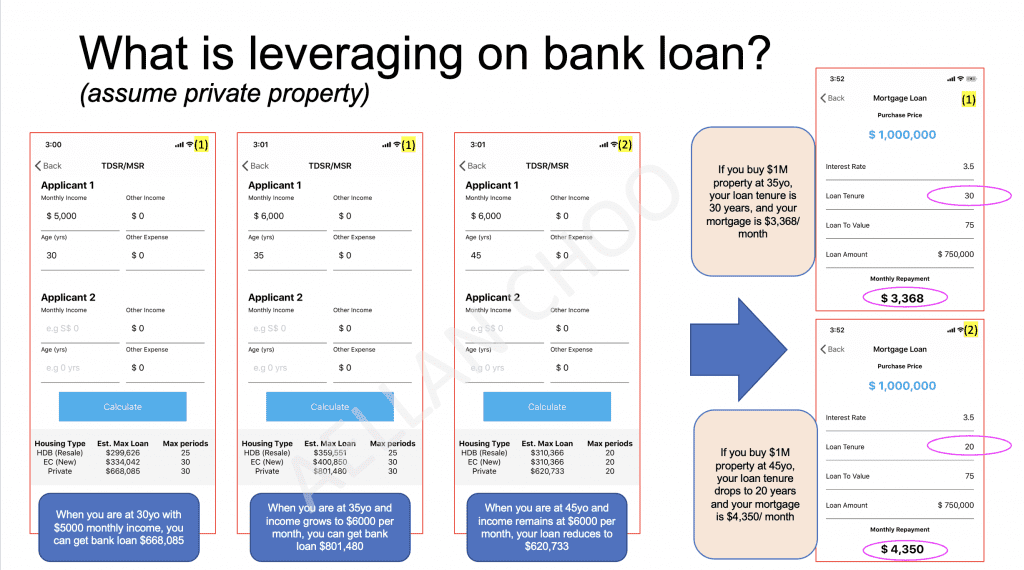

Very often I come across people who tell themselves that they cannot afford. When I asked them have they actually calculated? They did not work out the numbers and do not do anything. Over time, as you age, your ability to leverage on bank loan is reducing, means bank can only loan you lesser and your mortgage will increase.

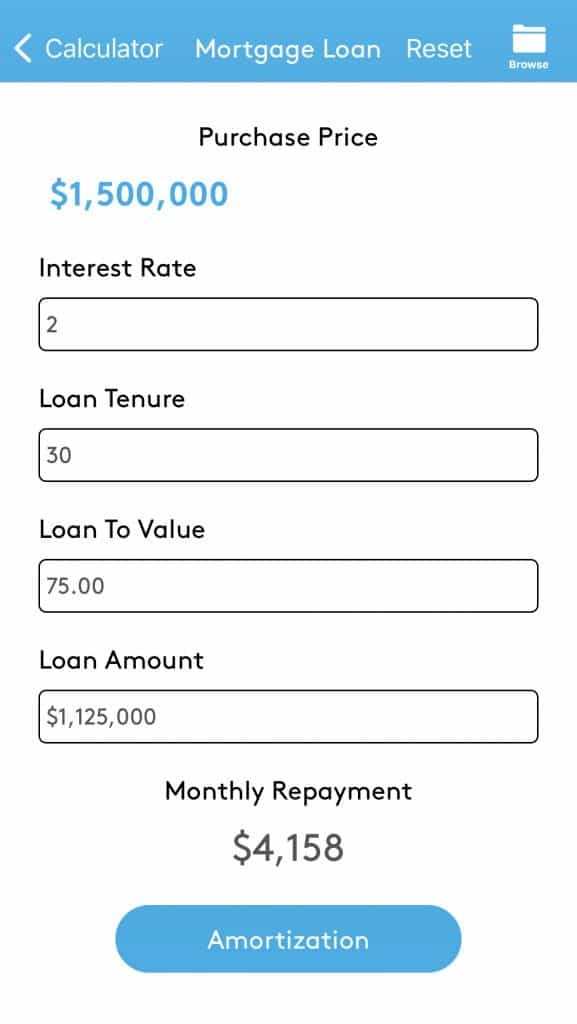

I have mortgage calculators to help you determine the loan amount. Or you may click here to punch in the figures.

If the numbers are not within your budget, then you need to adjust your purchase budget. Based on the monthly cash top up, is it comfortable for you?

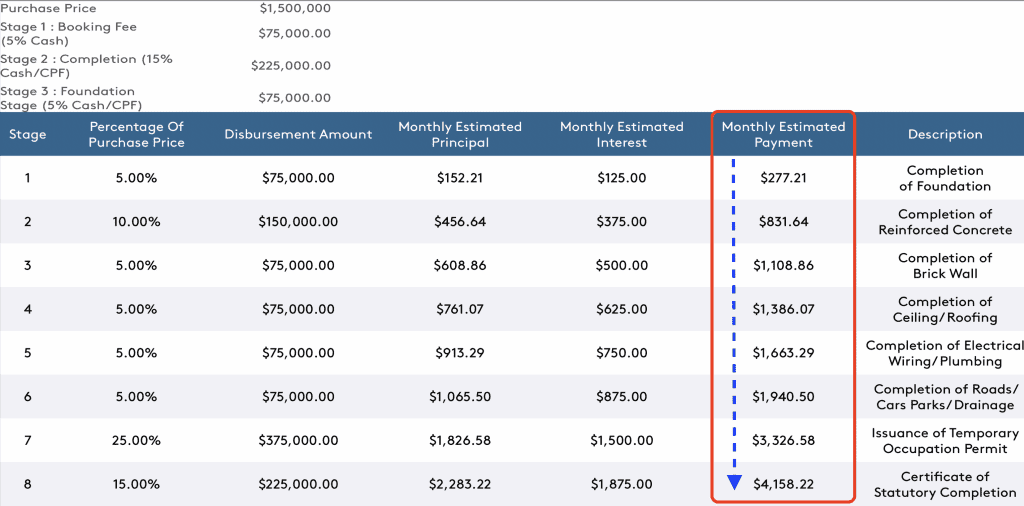

The other calculation that you need to be aware is the mortgage structure/ payment for a private new launch vs a private resale.

For new launches, take note that it is progressive payment. Many people out there do not know this is different to mortgage loan principle for a resale property. The advantage of buying a new launch is that you can buy a property, pay with little interests, and sell with profit during TOP.

Take a look at the comparison below.

Mortage Calculation for Resale Property at $1.5M

Progressive Payment for New Launch at $1.5M

Emotion 3: Why should I sell my house? It will continue to Go up!

Why should I sell my house? I want to keep it and continue to let it appreciate. Let’s say that you own this unit at age 37 years old,

881 North Bridge Road #21-08

SouthBank 958 sqft (2 Bed, 2 Bath)

Bought at $1,369,940 ($1430psf)

Monthly Rental $4,500

Monthly Mortgage $4,000

Cash Flow Per month is $500

Would you sell or hold this property? Would you exit if there is an offer for $1,600,000?

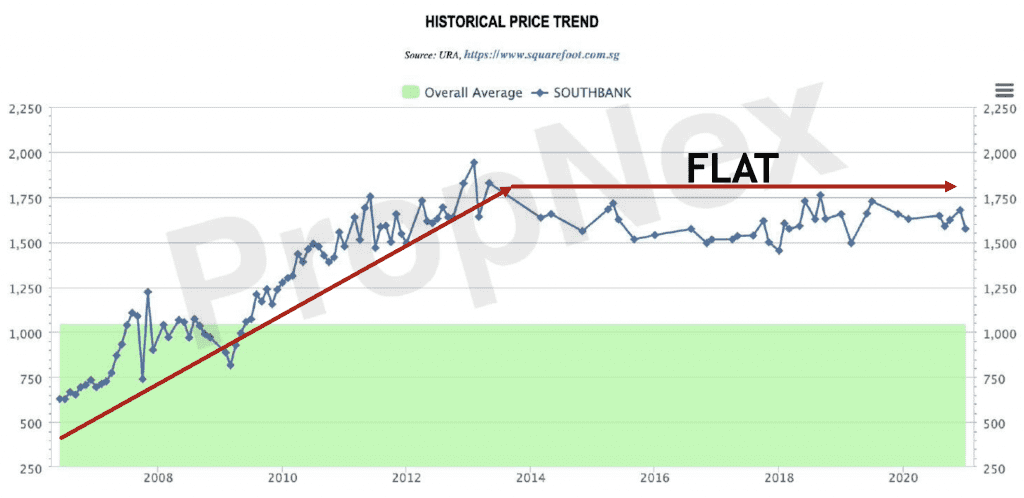

If you sold in 2014, you would make $230,000! Some may not sell as they feel that the $500 surplus is good enough. But the point is, the value of the property is not moving, it’s stagnant. The paper gain that you have is merely a NUMBER if you do not sell the property. They key is how you can properly utilise this paper gain to make your money work harder for you? Do not be emotional and fall into such trap. Ever wonder why the rich is becoming richer?

Historical Price Trend – SouthBank

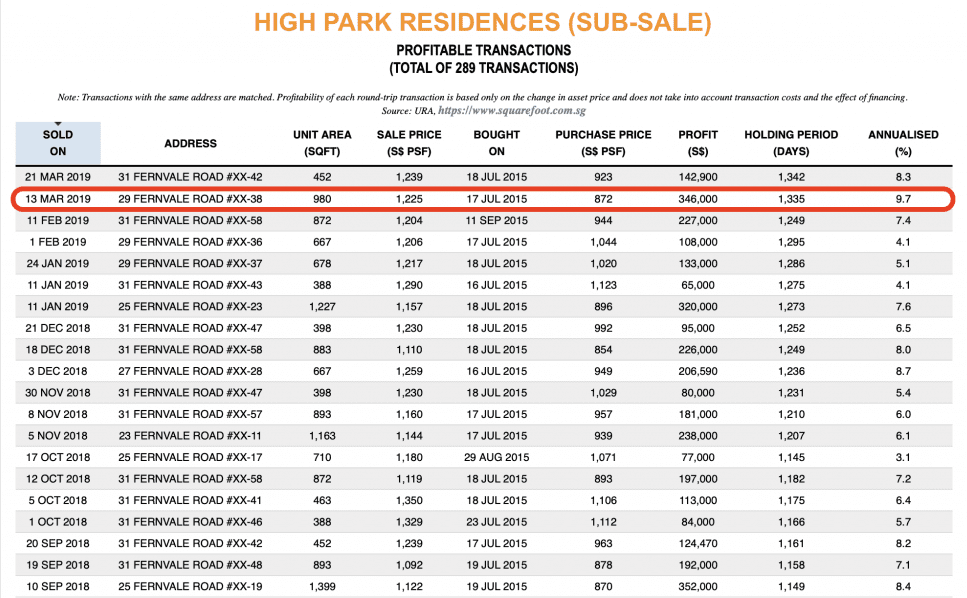

One of the things that they do is leveraging on Other People’s Money (OPM) to invest in highly profitable properties. They use properties that are stagnant or draw out the “trapped money” to get the MONEY to work harder for them. They will buy into properties that help them to make another round of profit. For example, if the same person sold Southbank in 2014 and got $230,000 profit, and bought a unit at High Park Residences in 2015, and resold in 2019, he would have gain another $346,000 profit! It is all about calculation and I can help you to calculate your affordability and assess your risk level.

You need to build capital via asset. It is not wrong to focus on rental income but why am I focusing on building capital, because it can help me to reinvest into profitable properties, make the profit, cash out and reinvest again.

Emotion 4 : Failed to use other people money to grow their wealth

Leveraging on the bank is one of the key instrument that helps real estate investors to create their wealth.

This is why the rich will never put money in bank. They will rather stay invested in property. A lot of people thinks that they need to save enough in order to buy, but they neglected that the bank will not be able to loan you much as they age. Take action when you are younger so that you can reap the fruits that you sow in future.

Emotion 5: Am I too late now since prices has gone up? Not the first mover anymore

A lot of people tell me that I need to buy at the first phase of the new launch, be the first mover in the purchase. Some development have already sold 40%-50% so is it too late to buy? Don’t jump into the conclusion and you should do research.

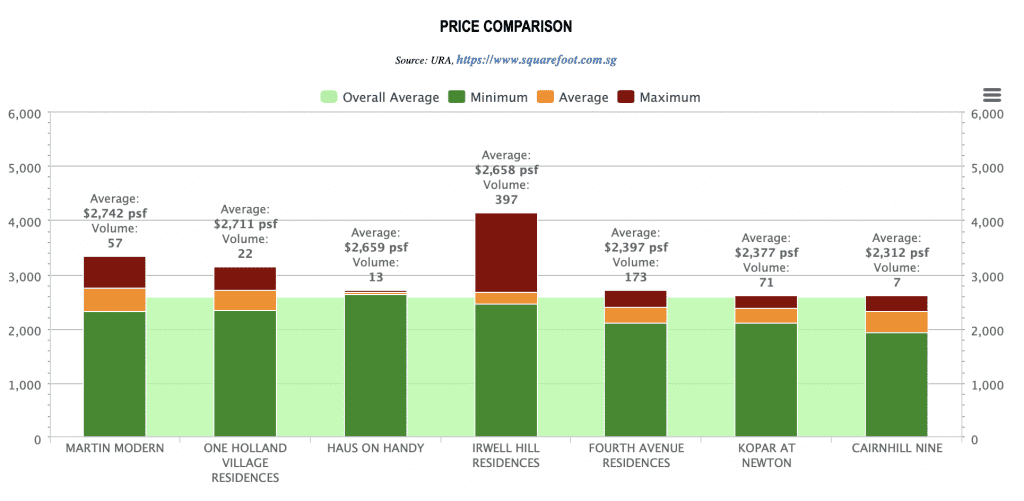

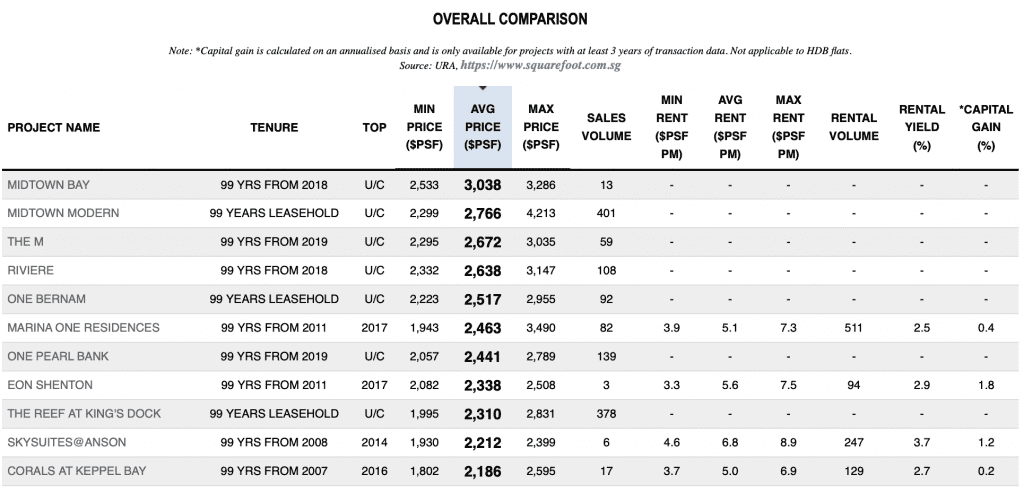

Using Kopar @ Newton as an example. Are you willing to buy $2300psf for Kopar at Newton, which is near to MRT. It is nearly 60% sold at point of writing this article. Would you buy it?

Don’t forget that the most important thing is to look at the transactions and let us compare against the new launches leasehold private properties in District 9 and 10. You can see that Kopar at Newton is one of them that is priced sensitively against similar leasehold new launches in District 9 and 10.

Here’s a step further, and we compare private new launches in city areas in District 1, 2, 3 and 7.

You can see that Kopar at Newton in the prime district in Singapore, is actually a value for money product! It’s not about late but you must understand the price tag that you are buying today. First mover advantage is important but remember to determine whether the price tag you are paying for is safe or not.

In summary

So these are the 5 common emotional traps that most people are facing. I hope that this article has provided you an open view point on how to approach investment using data driven methods to make proper judgements. Hearing from others commenting that the price is too high, wait for market to drop, wait for this and etc. are some of the common noises that distract you to really seek for your own opportunity.

If you are keen to find out which are the right properties to invest to grow your wealth, please contact me through my contact form or mobile phone.

Stay happy and most importantly, stay healthy.