This article is to give you the overview on the steps required to sell your private property in Singapore. What are the things to check and I have also provided some tips below to prepare your property for marketing it online or offline. Hope you find this useful or you can always reach out to me for free consultation.

Step 1: Before selling your private property, check if you are subjected to Seller’s Stamp Duty?

Some home owners overlook this matter and I will usually ask the seller, whether are they subjected to the Seller’s Stamp Duty (SSD) or not?

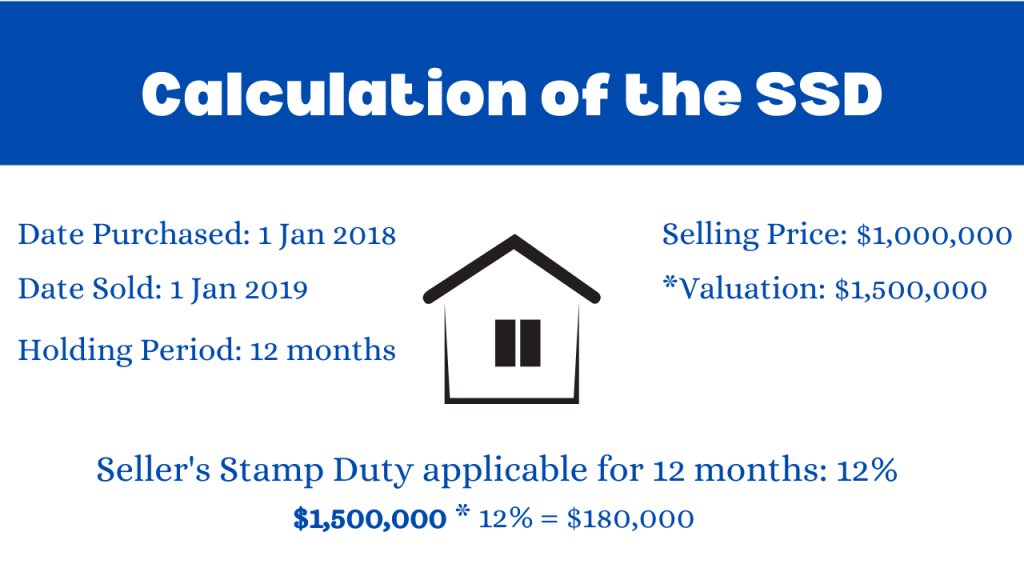

The measure of SSD payable relies on how long you have kept your property since the day you bought it. You can essentially sell your condo within several months of purchasing it; however, you will be subjected to the Seller’s Stamp Duty (SSD) if you do so. At the point of writing this article, SSD is not applicable if you have bought the property and sold off after 36 months from the day you exercised the purchase of the property. (Take note, date of exercise is the starting count down date for the SSD 36 months period.)

Seller’s Stamp Duty Rates

Up to 1 year: 12%

More than 1 year and up t o 2 years: 8%

More than 2 years and up to 3 years: 4%

More than 3 years: NO SSD Payable

The above is an example to calculate the SSD. You will realise that the example shows that the valuation is higher than the selling price. In such scenario, i am trying to show that the SSD rate applicable will be based on the selling price or valuation amount whichever is higher. Please take note of this.

If you really need to sell your condo within 3 years from the day you exercised the purchase, The Inland Revenue Authority Of Singapore (IRAS) will collect the SSD from you. The SSD is a form of tax, is designed to keep property prices within a reasonable range, to avoid investors from speculating the market. In the past, buyers could buy one or more units and flip it the next day for profit – This is what we referred to as flipping. If you’re not in a hurry to sell, I highly recommend waiting for the three years period to be over before selling.

Step 2: Calculate the costs:

If you’re trying to sell your current property to upgrade (or downgrade) to a more suitable location, the process is rather easy. Even so, you should be aware that you might encounter additional difficulties when you buy your next property while trying to sell the existing one.

For example, you need to ensure the amount of CPF OA that you can use after setting aside the BRS (Basic Retirement Sum) amount if you intend to use CPF.

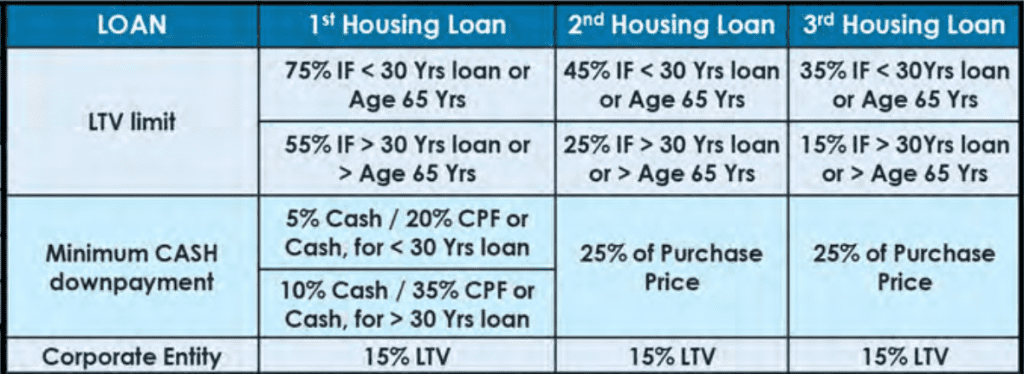

If you plan to take a loan and there is still outstanding loan for your current property, you will not be granted maximum 75% loan from the bank, instead the bank can only approve maximum 45% on 2nd housing loan.

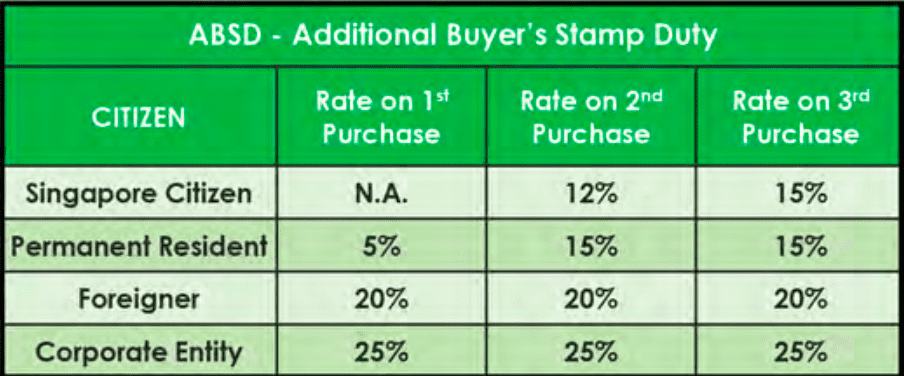

Additional Buyer’s Stamp Duty (ABSD) is also applicable when you purchase your next property before selling your current one.

The Additional Buyer’s Stamp Duty (ABSD) is levied on property owners who acquire their second and subsequent properties after the first. It is an additional tax imposed by the government on residential properties. Permanent Residents and Foreigners are also subjected to ABSD on their first and subsequent properties purchase.

Note that you are required to return back CPF amount used with accrued interest accumulated into your CPF Ordinary Account if you had purchased your current property using CPF funds. You can login to your CPF account and check how much CPF with accrued interests is required to be return back.

To calculate your cash proceeds from your sale (if any), the formula is simply

Selling Price – (CPF Used + CPF Accrued Interest) – Outstanding Loan = Cash Proceeds.

So remember to calculate your finances and available resources carefully.

Step 3: Creating a Timeline for both selling and buying

The selling process of a private property usually takes about 3 months to complete once you have found a buyer. While this timeline offers you somewhat more time to resettle, you would be interested in knowing when you’ll be able to sell your home before putting it on the market.

To ensure you don’t miss out on your ideal house, keep an eye on how rapidly apartments are being snatched up in that development. If you need more time to search for your next home, you can also negotiate flexibly with buyer upfront and indicate the agreed terms in the Option to Purchase (OTP). Most of the time, sellers will request for up to 3 months extension from the completion date to give themselves more time to renovate their new place.

Do you intend to sell your property first so as to raise funds necessary to acquire that luxurious new condominium? To ensure you are selling at your desired prices, check the current market circumstances.

Or do you plan to buy first to avoid missing out on a wonderful deal? If you’re purchasing two homes, please be sure that your finances can manage the extra burden, particularly if your existing home does not sell quickly.

The timeline is a common issue I have seen among many DIY sellers/ buyers and in some cases, the parties may engage in law suits to seek compensation.

Step 4: Determine whether or not to hire a real estate agent or do it yourself.

A private property can be sold in Singapore without the assistance of a real estate agent. Although it does have its own set of difficulties, you may want to consider hiring an agent anyway. Some of the difficulties you could encounter throughout the sale process are as follows:

- Before you issue the Option to Purchase (OTP), the buyer fails to obtain an In-Principle Approval (IPA) from their bank. You do not want a situation where you have committed to buy your next home then only to find out later that your buyer’s loan is not approved or insufficient and has no choice but not to exercise the Option.

- The failure to properly estimate the value of your property (and then having your property remain on the market for too long).

- The process of making your home attractive and presentable to potential buyers for property listings or house viewings.

- Not understanding how to sell your home via the appropriate methods (or inaccessibility to certain listing websites).

In addition, if you don’t have an administrative aptitude, you may also need assistance preparing your finances and schedule. I provide everything, including but not limited to

- If you plan to sell and buy at the same time, prepare an extended financial strategy. It is good to have backup plans, otherwise at least be aware of worse case scenarios.

- Your property will receive the most exposure possible by using premium marketing services in conjunction with ongoing optimization.

- Professional photographic services, as well as guided house tours, are available. An experienced negotiator working on your side will result in quicker sales and greater pricing for your products and services.

Step 5: Valuing your home and determining its selling price

A (Competitive Market Analysis) CMA for your property is the first thing to start off when determining how much to market your home for. This CMA is an In-depth comparison of the features of your home with similar properties in the surrounding area – floor space, orientation, layout, facing, and much more. Furthermore, I work with banks to get an estimate of the value of your property, but these estimates will vary between banks.

Step 6: Putting Your Property on the Market

This is the stage when you truly promote your home after all of your preparation work. This may be accomplished by placing advertisements in newspapers, but make sure you have excellent images of your house to attract the most qualified purchasers. Alternatively, you may make use of the free alternatives to real estate listings that are accessible. It’s still necessary to have nice images and a strong write-up, of course.

Tip: Before you take nice pictures of your property, ensure that you declutter items and keep it as presentable as possible. The logic is simple, no one will be attracted to enquire about the property if the pictures do not appeal nice to viewers. I also highly suggest giving older properties a fresh white coat of paint to revitalise the whole place. It does make a huge difference!

Step 7: Arrange for sale viewings

Do you have a few potential buyers lined up? Great! The time has come for you to prepare your property for potential buyers. A house should be in the best possible shape before you sell it, just as we would want to look our best for a job interview. Here are a few pointers:

Remove as much personalisation as you can from your home by decluttering it and organising it. Yes, decluttering does have an impact on the selling of your property. What I mean by personalisation for example, remove any nude artworks/ paintings or bold intriguing displays of yours. I have gotten feedbacks from potential buyers that they felt turnoff by such. I am not saying all buyers will make such feedbacks but we do not want to miss out any potential buyer in the process. After all, one man’s meat is another man’s poison. Consider repainting the walls and refinishing the flooring if you have the time and resources to devote to this by yourself, if possible. This will make your property seem well-maintained, which will make it more appealing to potential buyers.

The whole objective is to make viewers feel good the moment they step into your property and can visualise the area and layout well. Even if they may not end up choosing your property, you never know if they may spread positively by words of mouth or through social media!

Before every viewings, make sure there are no unpleasant aromas or scents in the house. There are products that you can buy to reduce or eliminate bad odours in the air. You may also explore using essential oils to refresh the air. (Have you been to hotels or shopping malls and felt how nice the scent is? It gives you a great feeling isn’t it?)

- Make an effort to arrange viewings in the day especially if one of the features of your property is that it is naturally well lighted.

- It might be a good idea to turn on the air-condition to let viewers feel comfortable when they are viewing your home. When viewers enter your home, you do not want them to start sweating all over.

Step 8: Issue the Option to Purchase (OTP)

Congratulations on selling your home! The bulk of the legwork is done now. Assuming your buyer has made a reasonable offer and you have accepted that offer, all you need to do is to issue an Option to Purchase (OTP). The Council of Estate Agencies (CEA) has provided a standard OTP in their website.

Take note that you can append additional terms or edit terms that are mutually agreed between parties in this standard OTP. The CEA standard OTP is not applicable for all use and you have to understand the legalities and obligations if you decide to draft the OTP yourself.

If you are not comfortable to do it, don’t worry; I will draft the OTP based on the agreed terms and conditions at no extra charge as part of my services. The most important thing is I must protect your interests in relation to the sale. I am also a professional real estate agent and passed the requirements of CEA.

Finally you will issue the OTP, in exchange of Buyer handing you the Option Fee (usually 1% of the purchase price).

Step 9: Wait for the buyer to exercise the OTP

The buyer will have 14 calendar days to decide whether or not to exercise the purchase. During this period, you will not be able to issue another OTP to anyone else before the option expires.

If the buyer exercise before the option expiry date (14 days), you will receive another 4% exercise fee from the buyer. Up to this point, Seller will already receive 5% in total from the Buyer. From there, you may want to hire a lawyer to take care of the remaining legal requirements.

If the buyer does not exercise before option expiry date, you will get to keep the Option Fee as buyer is deemed to have his option fee forfeited by not proceeding to exercise the Option. You will however have to relist your home on the market again.

Step 10: Invite Buyer for vacant inspection of unit

If the parties have agreed on no extension, you will be required to vacate the property before the transaction is completed. If parties have agreed on extension, you will be required to vacate by the end of such agreed date.

You will still be responsible for maintaining the property in much the same state, but there should not be any other issues to deal with. After you’ve packed and managed to move out everything, invite the buyer over for a final inspection to ensure that the property is vacant before the completion date or handover date.

Step 11: Finalise the transaction in the lawyer's office

Your long-awaited day has finally arrived!

Proceed to the lawyer’s office to hand over the keys, sign the relevant forms, and have all bank loan and CPF paperwork completed. In addition, you’ll need to pay your conveyancing fees, real estate agent commissions, and bank early repayment. The lawyers would then handle the formal transfer of the title deeds, so you’ll be ready to go.

Selling your private property requires proper planning in terms of financial, timeline planning, preparation, marketing, conducting viewings and performing negotiations. One should also have good knowledge in terms of principles of real estate and the legalities involved. Feel free to reach out to me if you require a free consultation.